Let me introduce you to Emily and her professional world. Emily is a seasoned API developer at a Nationalized Bank, a mid-sized retail bank with millions of customers across urban and rural branches. Emily’s job isn’t just limited to coding— she also takes care of the digital wireframe of the bank that processes thousands of transactions daily, from salary deposits to loan repayments.

There are multiple APIs in place that power everything, from the mobile app that rural farmers use to check microloan balances to the online portal where people in the city pay their credit card bills.

But we all know that in banking, the challenges are as unique as the customers you serve, and it can have a direct impact on their customers’ livelihoods.

Recently, a critical bug slipped into production. Customers were reporting that their orders were being duplicated, causing confusion and frustration. Upon investigation, Emily’s team discovered that the root cause was a failure in the API responsible for processing payments.

The API, which communicated with the payment gateway, was frequently timing out and causing duplicate requests to be sent.

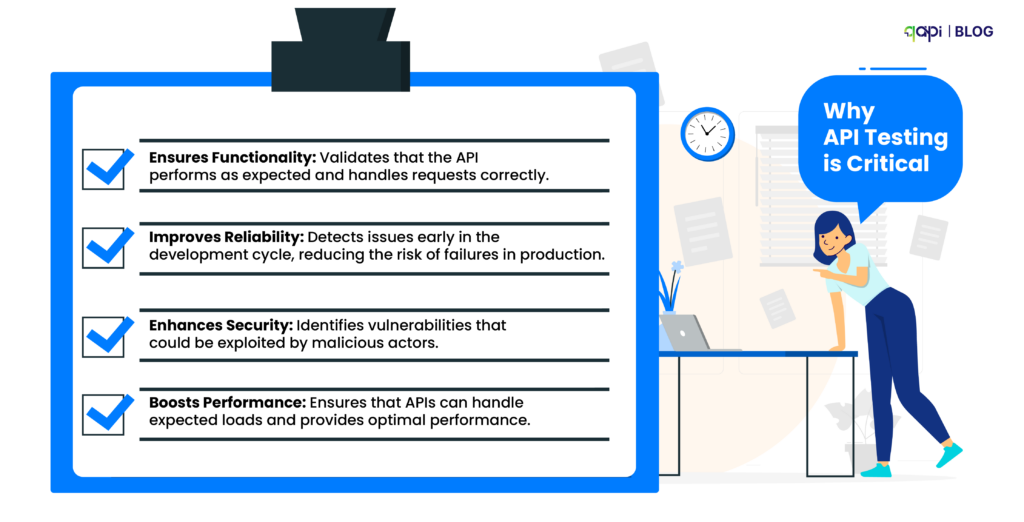

Had Emily’s team planned for a thorough API testing protocol, this bug could have been caught early. The incident was a wake-up call—as API testing was not just an option; it was now essential.

In this article, we’ll dive into the value of API testing features, showing how they tackle real-world challenges in banking, financial services, and insurance (BFSI).

And how it can completely change the outcome for such scenarios.

The High-Stakes Reality of Retail Banking APIs

Retail banking isn’t just about moving money—it’s about trust, accessibility, and real-time reliability. Emily and her team were using APIs that connected a farmer’s smartphone to a loan disbursement system, or a busy parent’s browser to a bill payment gateway.

When they work, no one notices. When they fail, the fallout is immediate: a delayed loan disbursement could mean a missed planting season, and a slow payment portal could really affect customer experience. In this sector, APIs aren’t just technology based—they’re the lifeline of financial transactions and customer loyalty.

Performance issues aren’t new for Emily. Like a sudden surge in loan applications during harvest season, led to payment failures on payday when thousands of transactions hit at once, or an overloaded API causing delays in real-time account updates. These can’t just cause an inconvenience—it directly affects customer trust and banking reliability.

Let’s rewind. What if Emily’s team had the right testing approach from the start?

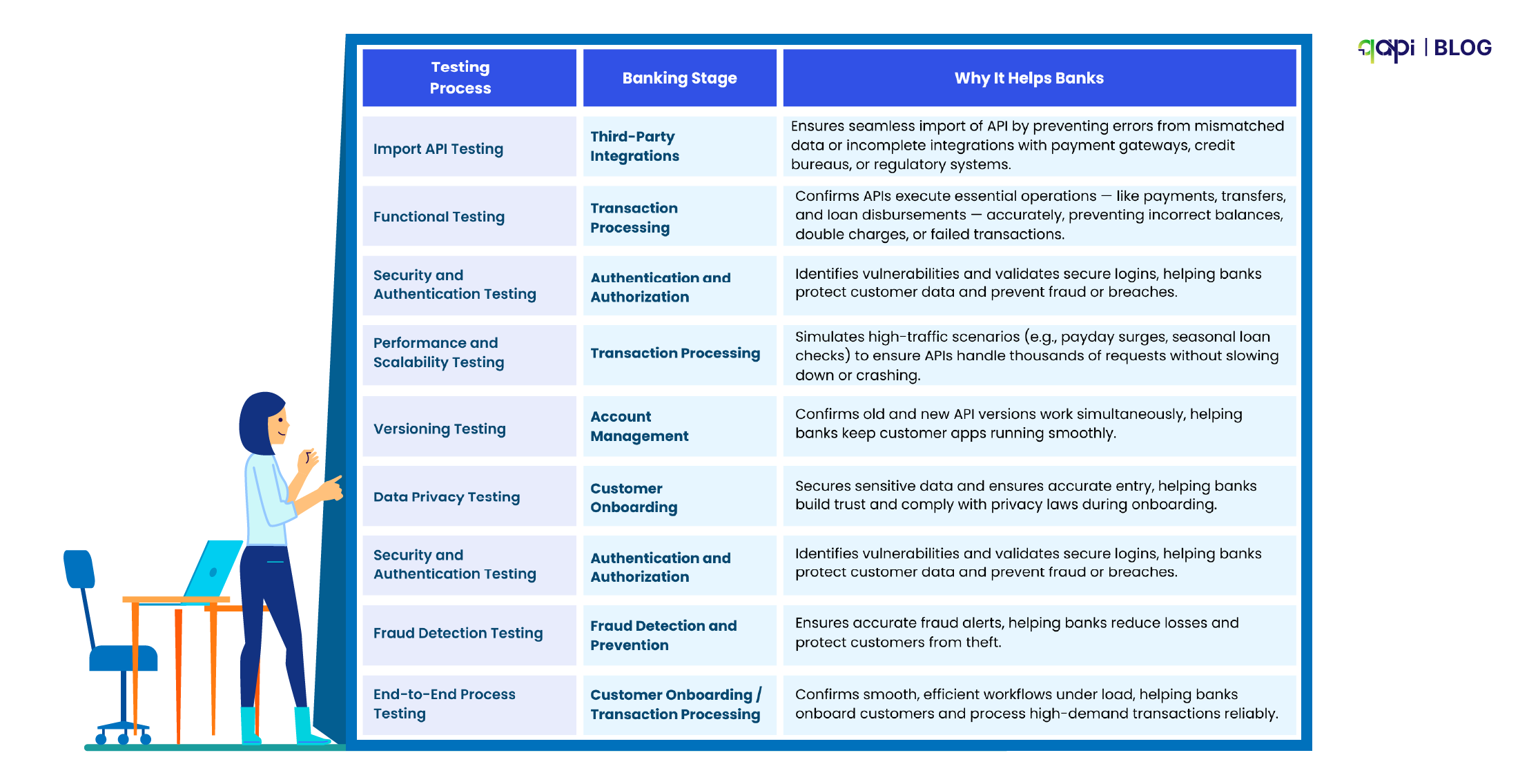

It begins with choosing the right tool and processes to test the API-layer, tools like qAPI make this easy to create, scale, and maintain. With the right tool in place teams can begin importing APIs efficiently.

Whether working with Swagger files, Postman collections, WSDLs, or even manual entries, having all APIs imported into a unified platform ensures no endpoint is missed. This step is critical — without it, teams waste time setting up tests manually or risk incomplete coverage.

After importing the endpoints, the team should have planned for writing test cases – many tools require users to code these themselves, however qAPI provides codeless assertions and even AI solutions that provide auto-generated test cases

This ensures each API is validated — checking requests, responses, and error handling — without needing to write complex scripts. For example, a payment API could be tested not only for successful transactions but also for edge cases like timeouts, retries, and partial failures.

For Emily, this could have mapped the payment processor’s API fast, flagging functional bugs minutes after a release to lower environments, rather than waiting for them to create problems with customers.

Codeless Testing for APIs

With APIs imported, Emily’s next challenge was testing under pressure. Not everyone on her team was a good coder, but all needed to pitch in. Business analysts, compliance officers, and even product managers needed to validate API behavior without writing complex code. This is where codeless API testing becomes a game-changer.

With an intuitive, drag-and-drop interface, anyone on Emily’s team could:

✅ Select an endpoint—no manual scripting required

✅ Set parameters and define expected responses

✅ Run automated tests with zero coding skills

By leveraging codeless testing, Emily’s team significantly accelerated test execution, ensuring APIs were validated for both functional tests and process tests.

Codeless Assertions

Running tests is half the battle—verifying results is the rest. Codeless assertions streamline this by-

Validating API response headers, response bodies, JSON Paths, and schemas can all be verified through a few clicks — no scripting required.

Users can even build many test cases for one endpoint to ensure there is proper coverage – validate a login endpoint with incorrect usernames, passwords, or invalid characters to ensure proper functionality across all scenarios.

This ensures that Emily’s team maintains high test coverage, quickly spotting any faults without diving into complex code.

Transitioning from securing APIs to handling unpredictable traffic spikes, Emily’s next challenge requires not just stability, but scale.

Building Scalable APIs—Defending Against the Invisible Enemy

Forget generic “cyber threats.” Emily’s nightmares are specific: Her bank supports a government microloan scheme for farmers, and every change in season, thousands flood the system to check balances.

Last year, 50,000 simultaneous hits crashed the API, causing a 20-minute outage. Branches were overwhelmed with calls, and customers were furious.

Retail banking APIs handle loads of sensitive data—think Aadhaar numbers in India, Social Security number in the U.S., or transaction histories that reveal a customer’s entire financial life.

There have been several cases like that. In February 2025, DeepSeek, faced a massive server resource constraints due to a sudden spike in global demand for their services. This unexpected surge led to server issues over a two-week period, ultimately forcing DeepSeek to temporarily suspend API service top-ups.

This shows the critical need for scalable and resilient API infrastructures to handle unpredictable traffic patterns. Similarly, Emily and her team needs to prepare their APIs for the worst.

She should use a tool that can run performance tests by simulating real-world surges —replicating 50,000 farmers checking balances simultaneously — while factoring in the bank’s aging mainframe’s limitations. It can detect a slow database query. Emily could have tested the fix, cutting response times from by at least 50% — just in time for the next spike in demand for microloans.

Enabling AI for API Testing

In the BFSI sector, maintaining regulatory compliance is complex and equally important. Financial institutions are under constant supervision to follow to evolving regulations aimed at ensuring consumer protection, financial stability, and market integrity.

In 2024, a leading European bank faced a €14 million fine when its loan approval API misinterpreted data, unintentionally offering loans to unqualified applicants — a direct violation of the region’s fair lending regulations.

qAPI offers automated testing, real-time monitoring, and AI-assisted risk assessments, functional tests ensuring Emily’s team stays ahead of regulatory changes. With AI-powered assertions, the platform automatically validates API responses against regulatory criteria — like ensuring loan approvals return compliant, unbiased decisions.

If Emily configures qAPI to verify that every API handling credit application in line to the bank’s fair lending policies — checking that approvals don’t factor in non-permissible data like postal codes or wrong sender data. If the API response deviates, qAPI flags it instantly, preventing non-compliant actions from reaching customers.

Better yet, qAPI can generate audit-ready reports with timestamps and response rate, helping Emily’s prep time from weeks to hours. When the next vigilance inspector knocks, she’ll hand over a binder that’s airtight—and impress them with all of the saved test reports from qAPI.

Keeping Systems Online and Intact

Here’s how qAPI’s AI-powered assertions could’ve prevented this from day one.

- Credit Approvals: Emily configures AI assertions to validate that loan approvals align with the bank’s policies. qAPI continuously checks whether critical data fields — like income source or repayment history — are correctly processed. If a regulatory update changes approval criteria, in qAPI you can update the test cases instantly and automate the tests, ensuring the API remains compliant.

- Fraud Detection: The bank relies on fraud detection APIs to monitor transactions. With qAPI in place, Emily’s team can configure a test that can ensure that these APIs validated to flag nefarious activity (e.g., farmers buying fertilizers in bulk). The AI learns from past behavior, raising alerts only on true anomalies — reducing false red flags that can frustrate customers.

- Payment Gateways: Failed payments mean both financial losses, potential regulatory penalties, and lost customers. qAPI facilitates continuous testing of payment APIs across cards and net banking — simulating timeouts, retries, and partial payments — ensuring seamless, regulation-compliant transactions every time.

Why It All Matters: Building Trust, One Test at a Time

For banking service providers, whether it’s processing payments, detecting fraud, or meeting regulatory demands, the difference between smooth operations and costly chaos often comes down to one thing: having the right protocols in place.

With qAPI’s codeless framework, you don’t need to be a coding wizard to set up these tests. A tester can drag, drop, and run a payment flow in minutes, ensuring every handshake between systems works like clockwork. All you need to understand is the application you are testing.

API testing lets us throw every possible fraud scenario at the system: unusual patterns, rapid-fire transactions, you name it. qAPI makes it practical, letting even non-technical team members build and automate these tests.

The result? A fraud detection system that’s as tough as the threats it’s up against. It’s fast—set up a test suite in hours, not days—and proactive, catching bugs before they hit production.

Emily’s story is a clear reflection of the expectations in retail banking

With qAPI in her toolkit, the narrative shifts:

- Security breaches are intercepted before they surface, with codeless, data-driven tests keeping APIs airtight.

- Traffic surges become predictable, with performance simulations ensuring the system holds strong — even under monsoon microloan spikes or unexpected viral demand.

- Compliance evolves from a reactive scramble to a proactive, AI-backed process — preventing errors before they escalate into regulatory problems.

- AI-assisted assertions help Emily’s team validate API responses faster and more accurately, reducing time spent on manual testing.

- Cloud-based scalability ensures that APIs perform under real-world loads, simulating thousands of concurrent users effortlessly.

- Support for multiple API types enables seamless testing of REST, GraphQL, and SOAP APIs while integrating easily into existing workflows.

The qAPI Discovery Chrome Plugin helps extract and automate API test cases and workflows directly from web applications, increasing coverage and efficiency.

Real-world test scenarios with API chaining and data plumbing ensure that test cases reflect actual user interactions, making API reliability a possibility.

With the right codeless API testing solution in your toolkit, you’re not just keeping up; you’re crafting workflows that bend to your will, tailored to your data, and designed to fit your unique challenges.

Remember that automating tests isn’t a set-it-and-forget-it task — it’s an ongoing process of improvement, and with qAPI you can stay a step ahead.

Get started today!